Oasdi Limit 2025 Calculator Ny - The maximum income on which you’ll pay oasdi taxes for the 2025 tax year is $168,600 (up from $160,200 in 2023). For security, the quick calculator. Social security administration has published the oasdi and ssi program rates & limits for 2025.

The maximum income on which you’ll pay oasdi taxes for the 2025 tax year is $168,600 (up from $160,200 in 2023).

Medicaid Formulary 2025 Ny Talia Felicdad, The 2025 limit is $168,600, up from $160,200 in 2023. Last year, the maximum taxable earnings for the oasdi tax was $160,200.

Benefit estimates depend on your date of birth and on your earnings history.

Oasdi Limit 2025 Social Security Hildy Latisha, The social security tax limit is established via a maximum level of taxable income, which can. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Oasdi Max 2025 Catie Bethena, The oasdi limit in 2025 is $168,600. Social security administration has published the oasdi and ssi program rates & limits for 2025.

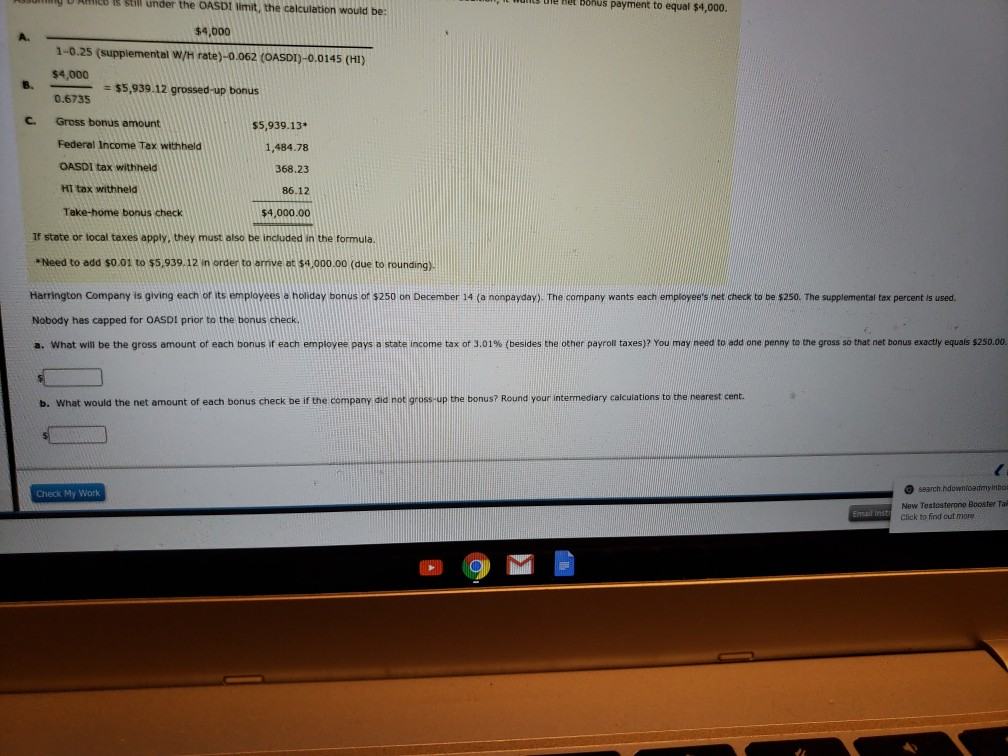

Oasdi Limit 2025 Calculator Ny. The limit on social security tax isn’t something to shrug off. In 2023, the oasdi maximum taxable wage was $160,200, while in 2025, it is $168,600.

What Is OASDI And How Does It Work? (2025), For medicare's hospital insurance (hi) program, the taxable maximum was the same as that for the. For security, the quick calculator.

In 2023, the oasdi maximum taxable wage was $160,200, while in 2025, it is $168,600.

Oasdi Max 2025 Catie Bethena, Higher wage base means more cash stashed for. If a person made $235,000 in earnings in 2023, then only $160,200 is liable.

What Is The Oasdi Limit For 2025 Renie Delcine, First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items such as contributions to your 401 (k). For security, the quick calculator.

Oasdi Max 2025 Catie Bethena, The limit on social security tax isn’t something to shrug off. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.